1️⃣ What is NPCI? 🤔

The National Payments Corporation of India (NPCI) is an umbrella organization that operates India’s retail payment and settlement systems. Established in 2008 under the guidance of RBI and Indian Banks’ Association, NPCI’s mission is to make India a cashless, digital economy by providing secure, efficient, and accessible payment solutions. 💳📲

Key Objectives:

- 🧑💻 Promote digital payments

- 🔒 Ensure secure transactions

- 🤝 Foster financial inclusion

2️⃣ NPCI Bank Links 🔗🏦

NPCI connects multiple banks and financial institutions across India to enable seamless transactions. Some of the key member banks include:

- 🏦 State Bank of India (SBI)

- 🏦 HDFC Bank

- 🏦 ICICI Bank

- 🏦 Axis Bank

- 🏦 Punjab National Bank

- …and 200+ more!

Through these links, NPCI facilitates interoperability and allows customers of different banks to transact easily via UPI, IMPS, AEPS, NACH, and other services. 🔄

3️⃣ How it Works ⚙️

NPCI operates multiple platforms that handle billions of transactions daily:

- UPI (Unified Payments Interface) 📱: Real-time bank-to-bank transfers.

- IMPS (Immediate Payment Service) ⚡: Instant interbank transfers.

- BHIM App 💡: Government-backed UPI app.

- RuPay Cards 💳: Domestic card network.

- AePS (Aadhaar Enabled Payment System) 🔑: Aadhaar-based transactions.

- NACH (National Automated Clearing House) 🔄: Bulk payments and auto-debits.

Each platform connects banks, payment apps, merchants, and users to create a vast, interoperable payment ecosystem. 🌐

4️⃣ NPCI Aadhaar Link Bank Account 🔐

Linking your Aadhaar number with your bank account through NPCI enables:

- 💸 Direct Benefit Transfer (DBT) of government subsidies

- 👥 Aadhaar-based authentication for secure transactions

- 🏦 Access to AEPS for rural & underserved populations

- Visit your bank branch 🏢

- Submit Aadhaar details online 💻

- Use ATM or mobile banking app 📲

Once linked, NPCI maintains a centralized mapper to route government benefits directly to your Aadhaar-linked account — ensuring transparency and efficiency in fund transfers. 🔄

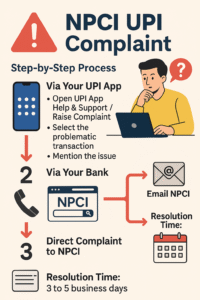

Even though UPI is known for its speed and reliability, sometimes transactions may fail or face delays. But don’t worry — NPCI has a well-structured grievance redressal system! 🙌

Common UPI Issues:

- ❌ Failed transactions

- 💸 Money debited but not credited

- 🕒 Delayed refunds

- 🔒 Authentication errors

How to File a Complaint in NPCI:

1️⃣ Through your bank or UPI app:

- Open your UPI app (like PhonePe, Google Pay, Paytm, etc.)

- Go to Help & Support / Raise Complaint

- Select the transaction and describe the issue.

2️⃣ Contact NPCI directly:

- Visit NPCI Complaint Portal 🌐

-

Here you go! 🔗

- Provide transaction ID, date, bank details, and issue description.

3️⃣ Email Support:

- You can also email NPCI’s support team: upi@npci.org.in 📧

👉 Note: NPCI works closely with member banks to resolve UPI complaints typically within 3 to 5 business days. ⚡

🏦 NPCI: Powering India’s Digital Payment Revolution

1️⃣ What is NPCI? 🤔

2️⃣ NPCI Bank Links 🔗🏦

3️⃣ How it Works ⚙️

4️⃣ NPCI Aadhaar Link Bank Account 🔐

5️⃣ NPCI UPI Complaint 🚩