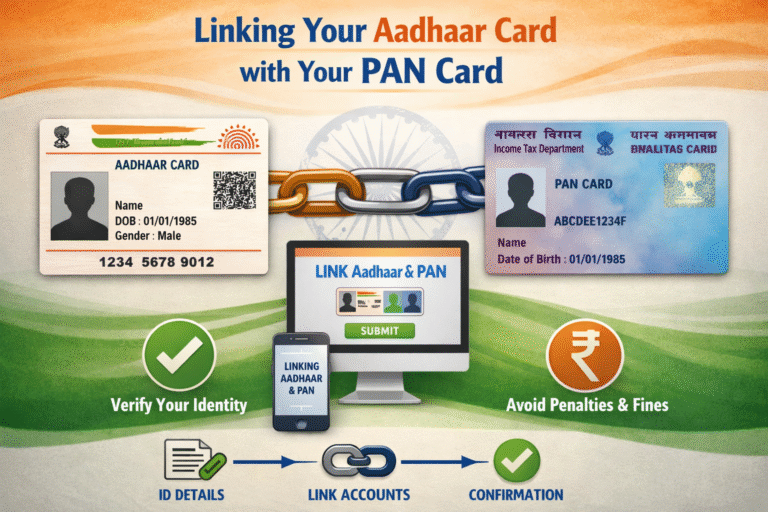

Linking your Aadhaar card with your PAN card is a mandatory process in India to ensure seamless tax compliance and prevent your PAN from becoming inoperative. This step-by-step guide outlines the simplest online method via the Income Tax e-filing portal, which is free if done before deadlines like December 31, 2025, for certain cases.proteantech+1

Why Link Aadhaar and PAN?

The government requires this linkage to verify identities and streamline ITR filing. Unlinked PANs may face higher TDS deductions or become inoperative, affecting financial transactions. As of 2025, those who used Aadhaar enrolment IDs for PAN can link using their final Aadhaar number by year-end.bajajfinserv+3

Online Linking Steps

Follow these steps on incometax.gov.in without logging in initially:

-

Visit the e-filing portal and click “Link Aadhaar” under Quick Links.stablemoney+1

-

Enter your PAN, Aadhaar number, full name (as per Aadhaar), and registered mobile number; click “Validate”.proteantech+1

-

Enter the OTP sent to your Aadhaar-linked mobile and submit; a confirmation pop-up appears, with processing in 7-30 days.cleartax+1

Check Linking Status

Go to the “Link Aadhaar Status” section on the portal, input your PAN and Aadhaar, and verify if linked. If post-deadline, a ₹1,000 penalty may apply via e-Pay Tax before relinking.razorpay+2

Offline or Alternative Options

Visit a PAN center (NSDL/UTIITSL) with documents for physical linking, or send SMS like “UIDPAN <Aadhaar> <PAN>” to 567678/56161. Always use official sites to avoid scams.fi+1